The Good, Bad and Ugly of Gov. Snyder’s First Budget

Gov. Rick Snyder’s first budget fell short of the “atomic bomb” promised by Lt. Gov. Brian Calley, in part due to the fact that a megaton of further spending and tax cuts were left on the table. Overall, however, the budget moves the state in a positive direction with greater tax simplicity, more transparency, less corporate welfare and fewer discriminatory tax policies.

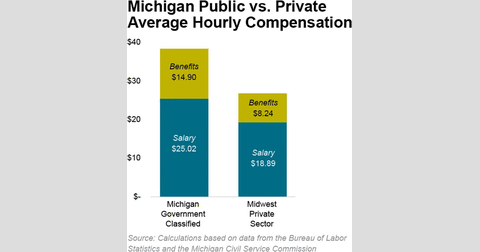

Among the lost opportunities is the fact that the net effect is a tax shift, not a tax cut. Yet as Mackinac Center analysts have shown, by bringing government employee benefits in line with private-sector averages, $5.7 billion in savings could be made available for real tax cuts without reducing programs or laying off employees.

That said, there’s plenty of good news here: Gov. Snyder intends to scrap the complicated and hated Michigan Business Tax and surcharge, replacing it with a simpler corporate flat tax of 6 percent. The Washington, D.C.-based Tax Foundation estimates this will move Michigan from 48th place in its business tax rankings to 22nd, even without a net tax cut.

Also positive is Gov. Snyder’s intention to eliminate the Michigan Economic Growth Authority and other discriminatory tax breaks. Given that the governor was once the vice chair of the Michigan Economic Development Corp., which presides over the state’s current corporate welfare regime, this has a certain “Nixon goes go to China” aspect. It’s not quite the “fair field and no favors” recommended by Mackinac Center scholars, because special treatment for certain firms won’t be eliminated entirely, but the process will henceforth will be done through straightforward legislative appropriations, bringing a huge leap in transparency.

And there are real cuts in this budget, including revenue sharing haircuts of up to $300 million, trimming school grants by $300 per pupil from current year levels, and $280 million from higher education spending. However, there are devilish details that may partially undercut potential savings — schools, universities and local governments may be able to reclaim some of those dollars by agreeing to reforms in their own governance, for example.

The most unfortunate part of the budget is the proposal to raise taxes on pensions. While the tax fairness and simplicity arguments are not invalid, it’s still a very large tax hike, and one that’s totally unnecessary — those $5.7 billion in potential government employee fringe benefit savings would save several times the estimated $700 million in new revenue from this tax. It’s worth noting that such a hike could be far more tolerable if the offsetting personal income tax cut was deeper. Currently, the personal income tax is scheduled to drop in Fiscal 2012 by one-tenth of 1 percent. In revenue terms, that’s about $161.8 million. A proper tradeoff for the pension tax hike would be an income tax cut of at least $700 million.

It’s worth mentioning, too, that the pension tax revenue projections may assume that taxpayers are just sheep who will stick around to be sheared, but many won’t. In effect, the move charges a retiree with a $40,000 annual pension about $1,700 a year for choosing to remain in Michigan rather than move to sunny, income tax-free Florida.

In his essay “How to Save $2.2 Billion,” my colleague Jack McHugh points out that just requiring school employees to pay 25 percent of their own health insurance premiums could save $650 million annually. Other ideas abound too. The state could devolve state police road patrols to county sheriffs and save $65 million. Mackinac Center analyst have published literally hundreds of ideas for saving more than $2 billion from the state budget since 2003, and many of the ideas have not yet been adopted or adapted by the state.

The governor also let slip an opportunity to call for even bolder reforms in government employee relations, such as those recently seen in states such as Wisconsin and Ohio. That may come in the future, but meanwhile, there’s much to like in this budget and tax proposal. In effect, it represents a huge change from an opaque and dishonest tax-and-spend system to one that transparent and forthright.

#####

Michael LaFaive is director of the Morey Fiscal Policy Initiative at the Mackinac Center for Public Policy, a research and educational institute headquartered in Midland, Mich. Permission to reprint in whole or in part is hereby granted, provided that the author and the Center are properly cited.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.