Michigan School Pension Debt Grows Again

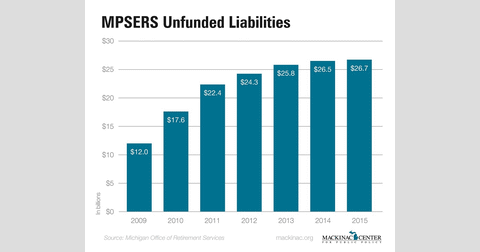

Unfunded liabilities double to $27 billion in six years, squeezing district finances

Michigan public school districts received bad financial news recently when the latest audit for the school employee pension plan showed that unfunded liabilities had increased again, this time by $200 million in 2015.

The statewide pension plan known as the Michigan Public School Employees Retirement System (MPSERS) saw its unfunded liabilities increase from $26.5 billion in 2014 to $26.7 billion in 2015. The unfunded liabilities were just $12.0 billion in 2009 but have more than doubled over the past six years.

The state has spent about $1 billion more on pension payments over the past six years, but it hasn't been enough. Past underfunding going back decades and bad investment and other funding assumptions is driving most of the liabilities.

The pension system has become a budget killer for school districts. For example, L’Anse Creuse saw its contribution to MPSERS increase from $14.7 million in 2014 to $19.3 million in 2015 — a 31 percent increase in just one year. School districts around the state collectively take on the rising costs of the unfunded liabilities.

The costs of maintaining the defined benefit system have also increased despite legislative reforms in 2010 and 2012 meant to improve its financial situation.

There was a total of 425,325 people vested in MPSERS in 2015. In that year, it paid out $4.5 billion to 207,651 retirees.

The Michigan (House) and (Senate) are both considering bills that would shift new employees out of the pension system and into a 401(k)-type retirement plan. By definition, 401(k)-type defined contribution plans cannot add unfunded liabilities for future taxpayers.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Faulty assumptions led to $2.3 billion catch-up on Michigan school pensions

Faulty assumptions led to $2.3 billion catch-up on Michigan school pensions

Michigan Teacher Shortage Turns 102 Years Old

Michigan Teacher Shortage Turns 102 Years Old

Michigan’s largest debt declines

Michigan’s largest debt declines