How Lansing Dodges Tax Cuts

Never admit state government is taking more

In a March 29 newspaper story about Gov. Rick Snyder’s proposed budget, Democratic politicians warned about “de-investment” in the state.

“In my opinion, Michigan has been a state where we’ve de-invested in so many things, that I’m not looking for de-investment now,” said Sen. Curtis Hertel Jr., D-Meridian Township, in a report out of The Detroit News. “If we want to give tax relief to the middle class, we can do it by actually making sure that corporations pay some part of their fair share.”

State Rep. Yousef Rabhi, D-Ann Arbor, echoed Hertel’s comments about more investment needed in the state.

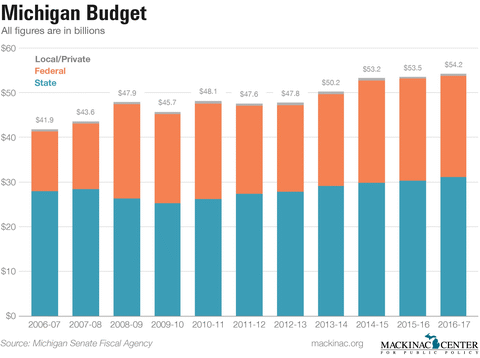

ForTheRecord says: Most of the political establishment in Lansing appears determined never to acknowledge that the amount of taxpayer money flowing into the Michigan Department of Treasury has risen every year since 2010-11. They instead try to create a perception of continual belt-tightening.

This bipartisan party line makes it harder to pass even a modest tax cut, as the Speaker of the House and most of the Republican caucus discovered in a failed Feb. 23 roll call vote on a 0.2 percent income tax cut.

State spending from state taxes and fees — not including federal money — has risen for seven consecutive years and is projected to rise again for an eighth time in the 2016-17 fiscal year.

The state spent $25.2 billion in 2009-10 and its spending in the current fiscal year will reach $31.1 billion. Snyder’s budget proposes to make state spending climb to $31.9 billion next year. These figures do not include federal dollars in the budget.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Anti-eviction advocacy group in Detroit due to get $20M from taxpayers

Anti-eviction advocacy group in Detroit due to get $20M from taxpayers

Two Detroit museums net $4M each in state budget

Two Detroit museums net $4M each in state budget

Flint business consultants get $500K from 2024 state budget

Flint business consultants get $500K from 2024 state budget