When Michigan has 2 million EVs, how many chargers will we need?

95% of chargers would be privately owned, per U.S. Department of Energy Read more

Whitmer: Don’t expect a tax cut in 2024

Governor speaks on behalf of lawmakers, despite 54-54 tie in the House Read more

Spending on public school in America now exceeds defense budget

In 2021, education spending eclipsed defense spending by $2B Read more

Membership plunges again for Michigan and national teachers unions

The Janus effect is still going strong Read more

Nearly half of Buick dealers opt out of EV revolution

Buyout has cost General Motors $1 billion so far Read more

UAW reaches tentative agreements with Stellantis and GM, ending strike

All three automakers are headed back to work; four-day work week left out of deal Read more

Ford’s UAW strike has ended; will BlueOval Battery Park resume?

Union leadership and state officials had linked pause to the strike Read more

UAW strike grows by 4,000; now affects 29,000 workers

Workers at Mack Trucks voted to reject a contract and will join the 25,000 other UAW members on strike Read more

Report: Michigan ‘poorest we’ve ever been’ in personal income

Michiganders earn 87 cents for every dollar earned in America Read more

Michigan has had 0% job growth in the Whitmer era

Governor says Michigan is the best for job creation, but the numbers tell a different story Read more

Auto workers can still resign from UAW and work during strike

Michigan’s right-to-work law, slated for repeal, is still in effect Read more

Mackinac Center on TV: Wright explains student loan lawsuit on Fox & Friends

‘Bad policy, illegally enacted,’ Wright says of Biden’s latest student loan forgiveness scheme Read more

Solar panels have a carbon emissions problem

It takes them much longer than reported to become carbon neutral Read more

Whitmer commission to grow Michigan starts work at undisclosed location

Advisory board disregards transparency in favor of secrecy Read more

Michigan prison stays cost $48K per year; here’s how that breaks down

One-fifth of the cost of a prison stay is health care and mental health, per the Michigan Department of Corrections Read more

Michigan doubled its EV numbers in one year

EVs are subsidized from production to purchase, including a $9B loan to Ford to boost battery production Read more

Report: DTE peak-hour rates hurt the poor

Poorer customers suffer ‘greater discomfort indoors,’ Detroit News reports, as summer A/C costs approach California levels Read more

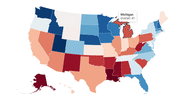

Michigan in bottom 10 among states in new report

U.S. News puts Great Lakes State in 41st place, with failing grades in crime, fiscal policy, infrastructure Read more

Electric vehicle transition kills hundreds of jobs at GM

Automaker looks to cut $2B in spending, per Detroit Free Press Read more

Whitmer decrees April 28 ‘Worker’s Memorial Day’

Don’t expect the day off, though Read more

Michigan lagged in economic performance in the 4th quarter of 2022

Slow growth continued in the fourth quarter of 2022 Read more

EV batteries can’t survive a scratch — Reuters

If cost and range anxiety weren’t enough of a problem, EV collisions will be costly Read more

Ford loses billions on EVs, despite government subsidies

Report: Ford Motor Company will lose $5B in two years on electric vehicles Read more

Report: TikTok banned on state of Michigan devices — except for Whitmer

MLive reports that governor is the sole state employee who has sought the TikTok exemption Read more

Manufacturing output is on the rise in America, but manufacturing jobs plummet

Manufacturing jobs are down 28% since 2001 Read more