Total Recall

Michigan Tax Revolts: 1983 and Today

(Editor’s note: This story was written for the March/April issue of Capitol Confidential and therefore does not contain the most recent information about on-going recall efforts.)

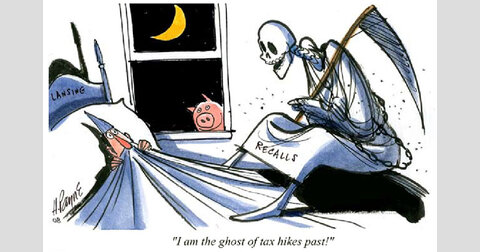

Anti-tax activists have announced plans to petition for the recall of as many as 10 Michigan lawmakers this spring and summer, and Speaker of the House Andy Dillon, D-Redford Twp., may be one of the top targets. Leon Drolet, head of the Michigan Taxpayers Alliance and coordinator of several of the recall efforts, believes that recalling the leader of a state legislative chamber would be the first of its kind in the nation. Sizing up the challenge, Drolet announced: "We’re ready to make history."

But it will be a tall order to eclipse the recall earthquake that re-routed Michigan history back in 1983. That year saw two Democratic state senators dismissed from office, two Republicans take their place, and the balance of power in the senate switch to the GOP — where it has remained ever since. Then-state Sen. John Engler, R-Mt Pleasant, was elevated to Senate Majority Leader, making him the primary political rival to then-Gov. James Blanchard, a Democrat. Seven years later in the 1990 campaign for governor, Engler would narrowly unseat Blanchard with a wildly improbable upset.

Then, as now, the fuse was lit with a tax increase. In 1983, it was an annual income tax hike of $675 million. Adjusted for inflation, this equates to more than $1.4 billion — close to the $1.385 billion hike in annual taxes that was approved this past fall.

Like re-elected Gov. Granholm in 2007, newly-elected Gov. Blanchard in 1983 was coming off of a successful election campaign in which he had dodged the question of raising taxes. Candidate Blanchard had pledged that tax increases would be used only as a last resort, yet before serving a full month in office he would propose a 38 percent hike in the state income tax. Gov. Granholm would wait only slightly longer, proposing her tax increase in early February 2007.

As was also the case with 2007, there was a "budget crisis" in 1983 — a period in which state government revenues were expected to be lower than the desired level of spending. Both times, the governors of the day appointed a panel of advisors to suggest solutions. Each panel recommended a mix of tax increases and cost reductions.

The Tax Hike

After hearing from his budget advisory panel, Gov. Blanchard proposed an income tax increase. Democrats also held control of both chambers of the state Legislature, and the leaders of the House and Senate each praised the Blanchard tax plan. Indeed, while the governor’s eventual proposal would cut spending $225 million, the two lawmakers had earlier endorsed balancing the budget entirely with tax increases.

On Jan. 28, 1983, the governor announced the release of a poll suggesting that 66 percent of voters supported tax hikes. Lawmakers who supported his plan, the governor asserted, would not be "purged" for doing so. Less than a week later, former GOP Gov. William Milliken announced that he would help Blanchard in a "bi-partisan" effort to promote the tax increase. Both men would later co-chair the panel that recommended a tax increase to Gov. Granholm in 2007.

With Democrats ruling the governor’s office and the entire Legislature in 1983, Republicans were powerless to stop any bill that the majority party was united behind. Nonetheless, Republican Senate Minority Leader John Engler did not automatically renounce tax hikes. He hinted that his party would be inclined to support a temporary increase, rather than the permanent one the governor was asking for. A Senate GOP proposal for a "1-year only" tax hike was later voted down.

By March 25, 1983, a tax hike was sitting on the governor’s desk. Except for Sen. Harry DeMaso, R-Battle Creek, every legislative Republican voted against it. The governor predicted that this partisan divide would not have lasting consequences, declared the tax debate over, and pronounced it time to move on to "other issues."

The Rebellion

Several weeks before the final tax vote in 1983, an estimated 700 protesters gathered in front of the capitol, threatening recalls. The rhetoric exceeded anything yet seen in the 2007 tax revolt. One protester held a sign calling Gov. Blanchard "the political anti-Christ" who was ushering in an "economic Auschwitz." Another held up a hangman’s noose, along with a note reading "hang the traitors." A recall petition against the governor would fail to force an election, but because of the publicity it generated two of the legislative "traitors" would not be so fortunate.

The modern tax revolt held a more muted capitol rally during the spring of 2007. Demonstrators wore stickers with the slogan "Recall 1983?" This event also featured the debut of "Mr. Perks," an eight-foot-tall, pink foam pig mounted atop a trailer. Property of Drolet and the Michigan Taxpayers Alliance, Perks has been used as an intimidating symbol of government largesse.

The pig was towed through the districts of lawmakers suspected of supporting higher taxes — at least one Republican and one Democrat. Both large Detroit newspapers covered the travels of Perks, and a TV news reporter from the Detroit area did part of his story about the MTA while riding along on Perks’ trailer. Meanwhile, the MTA and another group, Americans for Prosperity, paid for anti-tax phone messages to be patched in to voters living in two-dozen legislative districts. During this same period, Drolet — a former state representative who was term-limited out in 2006 — announced that he was drawing up a list of recall targets based upon lawmakers’ tax votes, and he began hosting seminars to train recall activists. Comparisons to the 1983 recalls w ere explicit and pervasive.

This pressure worked — for a while. On May 22, 2007, Dillon predicted a 50 percent chance that very week of a vote to hike taxes. But the next day, a Lansing newsletter carried the headline "Recall Threats Heat Up, Dems Freaked Out." Much of the spring and into the summer, Perks was parked on the capitol lawn and Drolet was perched in the gallery overlooking the House of Representatives. Spring became summer which became fall. The tax hike that was a 50/50 prospect in May still hadn’t happened through almost all of September. Eventually, on Sept. 30, 2007, the $1.385 billion tax increase was approved.

While the 2007 tax revolt was more successful in delaying the tax hike, it greatly benefited from the intimidation provided by the 1983 example. The 1983 tax revolt had no such precedent to point to, and while this made it much tougher to hold off the tax vote it did not stop opponents from trying. Before the final of the tax hike in March, 1983, Dan Powers, then a 25-year-old GM assembly line worker from Sterling Heights, presented Sen. David Serotkin, D-Mt Clemens, with a statement signed by 6,000 of his constituents opposing the tax increase. When the senator voted for the tax anyway, the autoworker — who says he voted to elect Serotkin the preceding November — became the leader of 10 volunteers seeking a recall. "We are out to reduce taxes," he would later say, "and the recall is the only way to do that."

As of this writing, the modern recall movement is still collecting names on petitions. To what degree it will relive the remainder of the 1983 drama remains unclear.

On July 26, 1983, an Oakland county arm of the tax revolt working against Sen. Phil Mastin, D-Pontiac, made history with the first-ever filing of signatures in support of a recall election to remove a state lawmaker. The group had collected 28,360 names within 90 days — 42 percent more than the minimum necessary. The signatures were certified as valid and the date for the first legislative recall election in Michigan history was set for Nov. 22, 1983.

On Sept. 21, 1983, Powers and his group submitted 23,400 signatures in support of a recall election against Serotkin, exceeding the required number by 27 percent. Serotkin’s election would be on Nov. 30.

The Recalls

Both politicians disputed that they could or should be removed over a single vote. Failing to convince judges on the legal merits of this theory, it became the theme of their campaigns. "The main issue is not taxes," Serotkin said shortly before the election. "The principle issue is what is [the] appropriate use for recalls. Is it appropriate to recall an official on the basis of one vote?"

Mastin thought media scrutiny of the extraordinary situation would bring his supporters out, and that many who signed the petitions against him would ultimately not bother to vote. With no other name on the ballot to contrast with them, each lawmaker also believed in stressing their entire record, thinking that if they could demonstrate something worth voting for to a wide cross-section of voters, then those voters would show up and vote for something versus an alternative of nothing. Mastin explained this strategy: "There have been a number of things that I’ve done that have sort of built a total, broader record that I hope the people will judge me by."

But recall proponents believed that the tax vote was the only issue that mattered, and relentlessly stuck to their theme. "I am a capitalist and I feel that Blanchard, Mastin and the others are a bunch of socialists," said Mick Steiner, head of the Mastin recall effort, less than two weeks before the election. "They want to take from the haves and give to the have-nots."

An adviser to both pro-recall campaigns thought little of the theory that petition signers would stay home, claiming that it "means something when people put their name on the line." On this basis, both teams focused their comparatively limited resources on contacting and mobilizing the people who had signed the petitions.

On Nov. 22, 1983, Mastin became the first Michigan lawmaker and – at that time – only the third state legislator in American history to be recalled. It wasn’t even close. The pro-recall side’s strategy of mobilizing their 28,360 petition signers was resoundingly vindicated in the 26,700 people who voted for removal. There were 15,990 votes to retain the senator.

Eight days later, similar lopsided results were inflicted on Serotkin, who spent $105,404 to save his job. His opponents spent less than $10,000 to take it away from him. Comparable finance figures applied to the Mastin recall.

Later, the Detroit Free Press wrote about the senators’ strategy of contrasting themselves with "nothing." The paper concluded that while voting against a particular candidate in any other election forced voters to consider the consequences of a different candidate and policies winning, the consequence of voting for recall was perceived to be just one less politician and no downside. The recall had become a referendum on government performance, as Serotkin described it after his defeat. The strategy of trying to change the subject to the entirety of the lawmakers’ records and the propriety of the recall elections may have been fatally counterproductive.

Aftermath

While the tax revolt continued to try and remove more lawmakers — and the governor — they did not succeed in forcing any more recall elections.

Serotkin did not go quietly. Still a legislator until the votes were certified, he opted to resign before certification was complete. While a recalled lawmaker is disqualified from running in the special election to fill the vacancy, Serotkin argued that a resignation before he was technically removed from office would nullify the recall and allow him to be a candidate to fill the vacancy that resulted from his "resignation." Then-Lt. Gov Martha Griffiths accepted Serotkin’s abdication, saying: "I hope it means that you’ll be coming back." That wish went unfulfilled as Attorney General Frank Kelley ruled against the gambit two days later.

The drama then turned back to taxes.

The law creating the higher income tax rate in 1983 dictated a partial rollback of $150 million effective on Jan. 1, 1984. But during the final weeks of 1983, just after the recalls, senate Democrats were anxious to douse the recall fires and hoping to salvage their majority by winning one or both of the special elections slated for January. With state coffers estimated to take in a surplus above what would be needed for the automatic rollback, the majority party proposed an additional tax reduction of $150 million.

Citing an ongoing cash deficit inherited from the previous administration that the he maintained was a more prudent use for the projected surplus, Gov. Blanchard promised to veto any bill giving additional tax relief. Then, stating that the tumultuous events of the preceding months had left the Legislature panicked and confused, he pleaded with them on Dec. 9 to adjourn for the year and go home.

Republicans won both of the special elections to replace the recalled senators and took a 20-18 majority control of the senate on Feb. 6, 1984. By this time, Gov. Blanchard had proposed an additional $130 million in tax relief starting with the 1985 fiscal year. But the new senate majority was looking for more relief — and sooner. On March 27, almost the one year anniversary of the 1983 income tax hike, the senate approved an additional $119 million in tax relief for 1984 and a total of $296 million for 1985. Sen. Patrick McCullough, D-Dearborn, had voted for the 1983 tax hike, but with a recall effort still pending against him, he voted this time for the more aggressive tax reduction schedule. Gov. Blanchard again promised a veto.

By July of 1984, the governor and Legislature had come to an agreement that reduced taxes $183 million more for 1985 and also scheduled a gradual but total phase-out of the entire 1983 tax hike by Oct. 1, 1987. Senate Majority Leader Engler deemed this compromise "inadequate," but better than nothing.

Two members of the improbably-acquired GOP senate majority voted against the tax cut compromise, but for far different reasons. DeMaso, the only Republican legislator to vote for the original 1983 tax hike, opposed giving any of it back, maintaining that there was "nothing wrong with having a surplus in the state treasury for a change."

The other GOP "no" vote was Serotkin’s replacement: Sen. Kirby Holmes, R-Utica. Owing his new job to the tax revolt, one of the first bills he introduced proposed to immediately repeal the entire 1983 tax increase. It was this bill that was amended and turned into what Engler referred to as the ‘inadequate’ compromise.

In a telling sign of how much had changed over the previous year, Holmes decided to vote against his own bill because it no longer cut taxes enough.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.