Grapes of Wrath

New law protects government-mandated “wholesaler monopoly”

Editor's Note: This article first appeared in the March/April 2009 print edition of Michigan Capitol Confidential. This is a reprint, relevant to a current issue in Michigan public policy.

A new state law prohibits Michigan connoisseurs of wine and beer from purchasing these products and having them shipped directly to their home from out-of-state retailers. Instead, all such purchases will be allowed only through a state-endorsed wholesaler. Introduced in November 2008 as House Bill 6644, the new law was quickly passed during the final days of the 2008 legislative session. It was overwhelmingly supported by 134 of the 148 members of the Michigan Legislature, and became Public Act 474 of 2008 upon being signed by the governor and enacted on Jan. 9, 2009.

Michiganvotes.org notes that the purpose of this law is to "avoid complying with a federal court ruling that held state restrictions on such shipments from out-of-state retailers to be a violation of the U.S. Constitution's commerce clause." The majority opinion in this case, Granholm v. Heald, relied in part on a July 2003 report from the United States Federal Trade Commission which concluded that prohibitions on interstate alcohol shipments should be abolished because they result in increased prices and restricted choice while failing to produce any measurable benefit.

The Specialty Wine Retailers Association, a national trade group representing out-of-state retailers, and groups representing legal-age wine drinkers, all opposed the Legislature's most recent circumvention of the Heald Case, as did the Michigan Restaurant Association. The major supporter of the law was the Michigan Beer and Wine Wholesalers Association, a politically powerful trade group that represents the state-endorsed wholesale beer and wine distributors.

While the Heald decision recognized Michigan's authority to regulate alcohol distribution within its borders (which is granted by the U.S. Constitution's 21st Amendment), it prohibited the state from applying a different standard to in-state and out-of-state wine and beer suppliers. Michigan lawmakers could have responded to this ruling by allowing Michigan consumers to save money by avoiding the MB&WWA middlemen, instead granting residents here direct access to all of the nation's federally licensed wine and beer suppliers. Some form of this standard is the law in many states. Instead, Public Act 474 essentially prohibits both in-state and out-of-state suppliers from shipping directly to Michigan customers, effectively blocking many out-of-state wine retailers from the Michigan market.

The MB&WWA forms the second tier of what is known as a "three-tier" distribution network. The first tier is producers, importers or other suppliers of beer and wine to the Michigan market; the third tier is the final retail seller, such as local stores and restaurants. Nearly all beer and wine sales in Michigan must pass through this licensing network.

The 2003 Federal Trade Commission report, "Possible Anticompetitive Barriers to E-Commerce: Wine," cites four historical justifications for why states such as Michigan use three-tier distribution networks to ban direct shipment, thereby creating a government-protected market for the middleman. Two of these reasons, preventing minors from purchasing alcohol and ensuring the collection of taxes, are still vehemently defended by the wholesalers and the state. However, both the FTC and a majority of the U.S. Supreme Court justices reject these rationales.

The FTC report concludes that "many states have decided that they can prevent direct shipping to minors through less restrictive means than a complete ban, such as requiring an adult signature at the point of delivery," and that these states "report few, if any, problems." Typical of such responses, an Illinois regulator told the FTC in early 2003 that mail-order shipment to minors was "not a serious problem." Likewise, a California official testified before that state's Legislature in 1997 that after 20 years of allowing direct shipment, they "never had an incident where there was a complaint about a minor receiving it." Likewise, a Dec. 7, 2004, article about the Heald case in the Detroit Free Press quotes the executive director of the Michigan Sheriffs' Association saying that he was "unaware of any issues" regarding minors buying wine online during the period when Michigan consumers could legally do so from in-state wineries.

Regulators from Illinois, Wisconsin and New Hampshire offered an opinion to the FTC regarding why this was so, each asserting that it was easier for minors to make an illegal purchase from a local "bricks-and-mortar" store. The FTC report cites a 2002 survey that backs up these speculations, finding that 68 to 95 percent of high school students claim that it is "fairly easy" or "very easy" to get alcohol in this fashion. The report notes that Michigan officials conducting sting operations found that alcohol could be obtained by minors from local retailers 55 percent of the time, even after a "valid Michigan license" was provided "that identified the customer as a minor."

In Heald, the majority opinion of the Court both cited and agreed with the FTC's conclusions, saying that Michigan and New York — the two states involved in the lawsuit — had provided "little evidence" of a problem with minors purchasing alcohol through the mail.

The Court also dismissed Michigan's claim that fears of tax evasion provided a reason for prohibiting direct shipment, calling it a "diversion" because "unlike many other states" Michigan does not use its three-tier system to collect taxes from producers. Instead, the opinion points out that Michigan collects taxes "directly from out-of-state suppliers" for what they voluntarily report shipping into the state.

Draconian federal penalties for violation of state tax laws, such as revocation of a retailer's federal license to sell alcohol in every state, are cited by the Court as a powerful incentive for honest self-reporting of tax liabilities, and state officials are empowered to bring suit against out-of-state violators of in-state laws.

The FTC reached similar conclusions, asserting that states with fewer restrictions on direct shipping report "few or no problems with tax collection."

Creating artificially high prices so as to discourage drinking is noted in the FTC report as the third of four historical reasons that states have used for prohibiting direct shipment outside of a three-tier network. Unlike preventing minors from purchasing alcohol or promoting the efficient collection of taxes, this third reason is not publicly offered by the MB&WWA as a justification for the existence of its membership's market protection. Nonetheless, the FTC concludes that increased prices and reduced choice for consumers is what occurs in the states where such arrangements are permitted to exist.

The director of the FTC's Office of Policy Planning teamed up with an Ohio State University political science professor in 2003 to examine Virginia's direct shipment ban. Their conclusions are included in the 2003 FTC wine report. They found that even after accounting for shipping costs, consumers in McLean, Va., would have saved an average of 8 to 13 percent per bottle for wines costing more than $20, and 20 to 21 percent per bottle on wines costing more than $40, if they had been permitted to avoid the state's direct shipment ban and order direct from out-of-state suppliers.

Furthermore, the McLean wine selection was found to be artificially restricted, precluding shoppers from finding "some of the more popular bottlings" to say nothing of "thousands of lesser known labels." Similarly, Wine Michigan, a trade industry group that represents Michigan wineries, asserts that there are "150,000 different wine labels available today in the United States," but that the MB&WWA — which it refers to as Michigan's "Wholesaler Monopoly" — has admitted to carrying only 10 percent of them.

These consumer benefit concerns were also given a sympathetic nod by a majority of the U.S. Supreme Court in Heald. The opinion asserts that the "extra layers of overhead increase the cost of out-of-state wines to Michigan consumers" and further that the "cost differential, and in some cases the inability to secure a wholesaler for small shipments, can effectively bar small wineries from the Michigan market."

"Preventing organized crime from gaining control of alcohol distribution," is the last of the four historical reasons the FTC reports as motivations for states deciding to create three-tier alcohol distribution networks. Though unaddressed by the rest of the report as well as the majority opinion in the Heald case, this concern was no trifling matter when Prohibition was repealed in 1933.

Charles "Lucky" Luciano was perhaps the most notorious example of the problem to be avoided. According to "Five Families,"

a book about the history of the New York underworld, this architect of the modern American mafia once bragged that his personal gross share of the New York bootlegging market in 1925 exceeded $12 million (more than $145 million in 2008 dollars), but that his net from this was just $4 million (more than $48 million in 2008), because of "overhead" that included not just salaries for staff, but also bribes to law enforcement and other officials.

Contrary to initial fears, organized crime's control of alcohol distribution did not survive after Prohibition, in the wake of which many states created three-tier distribution systems. Michigan's system dates back to 1933, the year of Prohibition's repeal. Today, the MB&WWA represents 75 private distributors, each with a state-granted privilege to control the flow of more than 90 percent of all the beer and wine that is consumed by Michigan residents. In 2004, the MB&WWA dedicated a new 8,500-square foot, $2 million Lansing headquarters. The reception area is named the "1933 Room."

This room was featured in a detailed series of articles about the MB&WWA written by Detroit Free Press reporter Jennifer Dixon and published between Feb. 10th and 12th, 2005. A popular location for state lawmakers to host fundraisers, the 1933 Room represents just one form of political influence that Dixon linked with the organization.

She asserts that Michigan wholesalers are "the envy of their industry" and quotes a former chairman of MB&WWA who claimed that they are routinely congratulated by out-of-state colleagues who note "how good we have it" in Michigan. High up amongst what he called the group's "blessings" is not being one of the states that allow consumers to avoid the middleman-wholesalers.

Because these government-sanctioned monopolies are privately held, businesses records of their value and profits are not public information. Dixon gives a hint as to their profit-making potential by citing statistics showing that one large Michigan distributor marks up each case of beer by $4 to $5 after getting it from Anheuser-Busch and before sending it along to a retail store. The wholesalers' chief lobbyist is quoted as saying that many of his members are millionaires.

What sustains these "blessings?" Dixon's work suggests that much of it involves political campaign contributions.

She found that all but nine of the 148 lawmakers elected to the Legislature in 2002 received a campaign contribution from the wholesalers. (Michigan Capitol Confidential research for this article discovered that all but 11 of the 148 lawmakers serving in 2008 and voting on the bill to create the direct shipment ban had received at least one such contribution during their career.) Michigan's current governor, attorney general and secretary of state are also recipients.

The Michigan Campaign Finance Network lists the wholesaler's political action committee as donating $722,698 during the 2006 election cycle, ranking it as the 14th largest PAC. However, unlike virtually all of those PACs listed higher, such as unions, business groups and funds linked directly to Democrat and Republican causes, Rich Robinson, director of the MCFN, told the Detroit Free Press that the MB&WWA is unique because it is one of the few that gives generously to politicians from both political parties.

And these donations are not trivial. MCFN analysis shows that the MB&WWA ranked as one of the "top contributors" for 88 of the 148 lawmakers during the 2006 election cycle. Winning this election put them in position to vote on the bill to ban direct shipment. For 65 of them, the MB&WWA was one of their five largest single sources of campaign cash; 51 of them received $4,000 or more from the wholesalers' PAC and eight senators received equal to or in excess of $9,000.

Dixon reported additional benefits given to some lawmakers. One front-page article highlighted a 2004 trip to Grand Cayman for four lawmakers — paid for by the MB&WWA — so that they could attend and speak at a wholesaler's event. Even though the Michigan Legislature was still in session during part of the trip, the four guests included the speaker of the House, the Senate minority leader, and the chair of the House committee that handles bills dealing with liquor regulation.

The newspaper notes that the trip cost the trade group $11,213, and that this was an "unusual lobbying tactic" given that their analysis of more than 100 other associations and corporations revealed "only a few" that reported trips for lawmakers with costs exceeding even $1,000. The article quotes the wholesalers' newsletter that described the trip as "five days of governance, business seminars, social events, sporting activities and to just kick back from the winter doldrums of the Midwest."

Because the lawmakers spoke at the gathering, and thus ostensibly provided something of value to the wholesalers, under Michigan law they were entitled to have the cost of their trip paid for by the MB&WWA. Similar trips have been provided to resorts in Cabo San Lucas, Palm Beach, the Bahamas and more. One of the four lawmakers in attendance at the Grand Cayman event was asked by Dixon what the wholesalers got for such expenditures. He replied: "They get a lot of goodwill, no doubt about it."

That lawmaker, State Rep. Ed Gaffney, R-Grosse Pointe Farms, was one of 98 state representatives to vote in favor of the bill to ban direct shipment of beer and wine to adult customers. It was one of his last acts as a term-limited state legislator. On Jan. 16, 2009, just over two weeks after he left office and exactly one week after Gov. Granholm signed the direct-shipment ban into law, the governor appointed Mr. Gaffney to a seat on the Michigan Liquor Control Commission, the primary regulatory agency that oversees the state's beer and wine wholesaler industry. This job pays $82,000 per year.

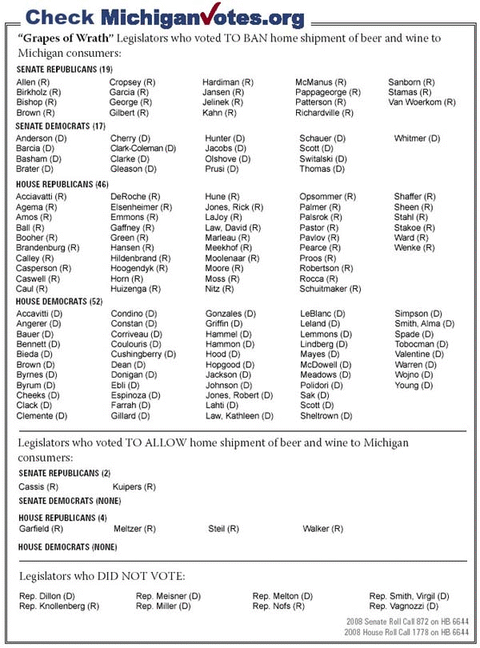

Thirty-six senators also voted in favor of the ban. Four state representatives voted against the ban, along with two senators. The Michiganvotes.org roll call vote for 2008 House Bill 6644 appears below. See Who Are Your Lawmakers? for contact information on your legislators.

For additional information and an opportunity to comment on this issue, please see www.mackinac.org/10207.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.