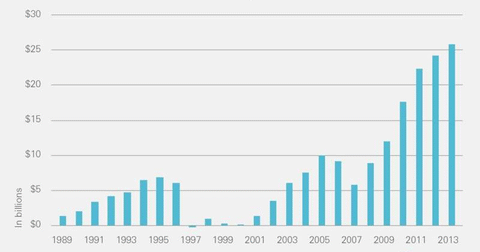

Michigan Teacher Pension System Liabilities Increase Again

System underfunding up to $25.8 billion

Public school administrators have called the costs for the teachers' pension fund a budget breaker. They won't be happy to learn the costs are increasing.

The Michigan Public School Employees Retirement System (MPSERS) saw its unfunded liability increase to $25.8 billion in 2013 from $24.3 billion in 2012, according to the annual actuarial valuation report from the accounting firm, Gabriel Roeder Smith & Company. The pension liability in 2009 was about $12 billion.

James Hohman, assistant director of fiscal policy at the Mackinac Center for Public Policy, said the additional unfunded liability is from the low rate of returns during the Great Recession that are still being factored in due to several years of “smoothing” where pension funds blend several years of returns and get an average rate. Hohman said it's possible the returns could be higher than the projected 8 percent in the future, but there are no assurances.

"That's hopeful thinking, which is inappropriate for policy makers to engage in," Hohman said. "They need to acknowledge the problems of optimistic assumptions, which have harmed state and school finances."

In 2012, Michigan legislators enacted reforms to deal with MPSERS’ unfunded liability. Those included increasing employee contributions to the plan, limiting some benefits and giving new employees the option of joining a 401(k)-type plan.

"This is why tweaks don't matter," Hohman said. "You have to stop the system from developing these unfunded liabilities. This plan is still a major danger to state finances."

Ari Adler, press secretary for House Speaker Jase Bolger, R-Marshall, said the reforms have worked. Adler included the MPSERS health care unfunded liability in his response, which changes the valuations.

"According to the House Fiscal Agency, unfunded actuarial accrued liability was at $45.26 billion back in Fiscal Year 2010 and increased to $48.28 billion in Fiscal Year 2011. After the Republicans pushed through MPSERS reform, we saw that trend turn around dramatically," he said. "For Fiscal Year 2013, that level was $38.29 billion. (This includes $25.8 billion in pension and $12.49 billion in health care.) Because of our reforms, the unfunded liabilities will continue to drop overall, even if there are fluctuations when comparing year-to-year totals. So, your premise that the unfunded liabilities 'are growing' is incorrect. Fluctuations can be caused by many factors, including the number of people in the system, the number of people drawing a pension and healthcare, etc.”

Dave Murray, spokesman for Gov. Rick Snyder, also included the MPSERS health care unfunded liability in his response.

"MPSERS was on an unsustainable path and needed to be reformed," Murray said. "Gov. Snyder was adamant that the long-term, unfunded liabilities were placing an extreme burden on school budgets, draining resources from the classroom. Those liabilities were about $45 billion before the reforms and have been reduced by about $20 billion. The reforms protect the employees, making sure they have the needed and promised benefits when they retire, and they make sure school districts have resources to use on improving academics. When coupled with the other educational reforms the administration has set in place, Michigan schools will be stronger and better able to prepare students with in-demand skills, building a foundation for long-term success for both the children and the state as a whole."

The Michigan State Employees Retirement System (MSERS) was closed to new state employees in 1997. Teachers were excluded from that reform. Now, the state automatically puts in 4 percent of state employees' salary into 401(k)-type plans and could put in an additional optional 3 percent. Teachers still get traditional pensions.

Shifting state employees has saved taxpayers an estimated $2.3 to $4.3 billion.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Payouts from Michigan’s teacher loan program plummet 97% after rule change

Payouts from Michigan’s teacher loan program plummet 97% after rule change

Michigan’s largest debt declines

Michigan’s largest debt declines

Michigan House scheduled to vote June 20 on diverting $670M from teacher debt to other projects

Michigan House scheduled to vote June 20 on diverting $670M from teacher debt to other projects