Commentary

Job Churn Shows Why Targeted Tax Favors Do Not Work

There is constant job loss and creation in the state economy

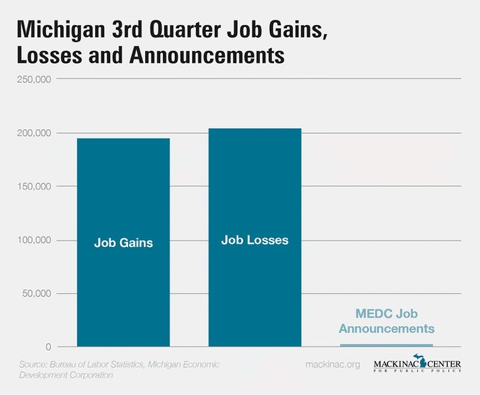

There is an underappreciated level of both job creation and job loss constantly happening in Michigan. This can be seen in the most recent “job churn” figures covering July through September of 2015. During that quarter 195,118 jobs were created in Michigan, and 204,087 jobs disappeared according to the Bureau of Labor Statistics.

That is out of around 3.6 million Michigan jobs included in this particular federal database. Thus, about one out of every 18 Michigan jobs was newly created during this three month span, and another one out of 18 jobs disappeared.

This remarkable “job churn” demonstrates why politicians’ economic development programs repeatedly fail to make much of difference.

Also in the third quarter of 2015, the Michigan Economic Development Corporation announced that companies getting state support would create 1,916 jobs. So even if the programs were costless and all the promised jobs were created (they rarely are), they would represent just 1 percent of the total job creation and destruction that goes on in Michigan every three months. Plus, the awards given to these companies cost taxpayers and this calls into question whether the net effect is positive for the state.

Nevertheless, the case for keeping these programs is often cast in terms of pragmatism. To paraphrase, boosters say they don’t care about ideology, only about doing things that create jobs.

Except the programs are not pragmatic. They are unable to produce the effect that they claim. They have no real or measurable practical impact. As the job churn figures illustrate, their scope and magnitude are just a fraction of what would be required to have a meaningful impact on the economy.

Instead, the things that matter to the state’s economic growth are broad-based rules and policies that impact a large number of businesses. The state has improved some of these over the last several years, but ought to consider more — such as lowering the state income tax rate, reducing the state’s regulatory burden and lowering the barrier to entrepreneurship by scaling back occupational licensing requirements.

|

Job Churn Shows Why Targeted Tax Favors Do Not Work

There is constant job loss and creation in the state economy

There is an underappreciated level of both job creation and job loss constantly happening in Michigan. This can be seen in the most recent “job churn” figures covering July through September of 2015. During that quarter 195,118 jobs were created in Michigan, and 204,087 jobs disappeared according to the Bureau of Labor Statistics.

That is out of around 3.6 million Michigan jobs included in this particular federal database. Thus, about one out of every 18 Michigan jobs was newly created during this three month span, and another one out of 18 jobs disappeared.

This remarkable “job churn” demonstrates why politicians’ economic development programs repeatedly fail to make much of difference.

Also in the third quarter of 2015, the Michigan Economic Development Corporation announced that companies getting state support would create 1,916 jobs. So even if the programs were costless and all the promised jobs were created (they rarely are), they would represent just 1 percent of the total job creation and destruction that goes on in Michigan every three months. Plus, the awards given to these companies cost taxpayers and this calls into question whether the net effect is positive for the state.

Nevertheless, the case for keeping these programs is often cast in terms of pragmatism. To paraphrase, boosters say they don’t care about ideology, only about doing things that create jobs.

Except the programs are not pragmatic. They are unable to produce the effect that they claim. They have no real or measurable practical impact. As the job churn figures illustrate, their scope and magnitude are just a fraction of what would be required to have a meaningful impact on the economy.

Instead, the things that matter to the state’s economic growth are broad-based rules and policies that impact a large number of businesses. The state has improved some of these over the last several years, but ought to consider more — such as lowering the state income tax rate, reducing the state’s regulatory burden and lowering the barrier to entrepreneurship by scaling back occupational licensing requirements.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

More From CapCon