Legislators Should Look To Oklahoma To Address Pension Change ‘Transition Costs’

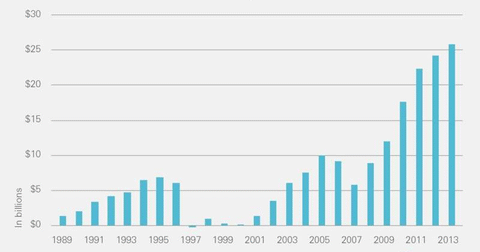

The unfunded liabilities for Michigan’s school pension fund increased to $25.8 billion this year. Legislators may feel that there is nothing to be done to prevent these liabilities from racking up, but they’re wrong.

They can close the plan and offer new employees participation in a defined contribution plan, where the state cannot underfund benefits. Recent developments in Oklahoma shed light on how they can do this without triggering restrictive “transition costs.”

In the face of growing unfunded liabilities in its pension system, Oklahoma closed its pension system to new employees of the state and participating municipalities. The state now offers state workers a defined contribution plan with 7 percent matching contributions.

Actuaries often recommend switching how unfunded liabilities are accounted for when a plan closes, and these changes tend to imply a more front loaded payment mechanism. The increased cash contribution from this accounting change is called the transition cost. Yet the state will continue to keep its previous methods for paying down unfunded liabilities, avoiding even this different accounting treatment.

That is, the state will continue amortizing unfunded liabilities over the payroll of members of the defined contribution plan as well as those of the defined benefit plan. No accounting change will occur to trigger those phantom “transition costs.”

This option was mentioned in my 2012 study on transition costs in the school pension system, “Five Options for Addressing ‘Transition Costs’ When Closing the MPSERS Pension Plan.” If legislators feel their current policies for paying down unfunded liabilities in MPSERS are prudent, they have no need to change them if they decide to close the system.

The school pension system currently costs more than 30 percent of payroll and the new unfunded liabilities will continue to increase these rates. School employees ought to have a plan that is current and predictable, in addition to being affordable to their employers.

Oklahoma shows that this can be done in a way that avoids the phantom transition costs.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

East Lansing climbs out of pension hole

East Lansing climbs out of pension hole

Don’t redirect pension funds

Don’t redirect pension funds

Michigan’s largest debt declines

Michigan’s largest debt declines

Jobs agency ghost-writes its own public relations