The Worst Funded Pension Systems In Michigan

Part 1 in a series looking at municipal retiree funds in the state

Editor's Note: The initial article and graphic inadvertently included underfunded Other Post-Employment Benefits (OPEB) information and listed Plymouth Township instead of the City of Plymouth. It has been corrected.

A large cause of Detroit’s historic bankruptcy in 2013 was its grossly underfunded retiree systems for public employees. At the time, the estimates of the amount of unfunded liabilities in the general pension system ran from 94 percent to 65 percent.

But few people realize that many of Michigan’s largest cities have pension benefit systems in far worse conditions than Detroit.

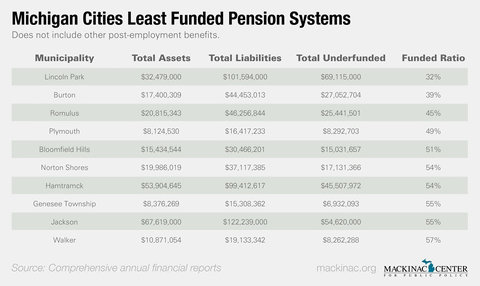

A review of the Comprehensive Annual Financial Reports (CAFR) by Capitol Confidential of the employee pension systems for Michigan’s 100 largest municipalities shows that many of them are 65 percent funded or worse. One system, Lincoln Park, is only 32 percent funded – that is, for every dollar promised to future retirees, the city has put aside only 32 cents.

Five of Michigan's 100 largest cities are 50 percent funded or less; a scary amount of liabilities.

Most of the state’s largest cities continue to offer pensions and these defined benefit plans have racked up billions in combined unfunded liabilities for taxpayers. This does not include the amount of liabilities for Other Post-Employment Benefits (OPEB) which are almost always even less funded.

There is some hope. In 1997, Michigan legislators began shifting new state employees off of the pension system and providing them with 401k-type retirement plans. These are known as “defined contribution” rather than “defined benefit” pension plans. This has saved taxpayers an estimated $2.3 to $4.3 billion – and likely saved state workers from a severe pension haircut in the future.

One of the key people who helped with that shift is former Michigan Treasurer Douglas Roberts. In a recent interview, he spoke about the difficulty of defined benefit systems.

“Pensions represent future costs, and the future can be unpredictable,” Roberts told the Reason Foundation. “Forecasting future costs can be imprecise. Accounting assumptions can change. [E]conomic conditions can change. But short-term decisions made in the past don’t always fit the longer-term view of the future.”

Some local governments are beginning to shift their new employees off of pension systems and towards a 401k plan where the retirement money flows to the workers rather than the state. With a defined contribution plan, it is impossible for politicians to kick the fiscal can down the road to future employees and taxpayers. This shift has led to cost savings and is helping cities avoid the fate of Detroit.

Other municipalities are ignoring the warning signs. Either from a lack of political will or misaligned incentives, these local leaders are not doing much to avoid fiscal calamity.

One problem local elected officials who want to enact real pension reform face is how politically difficult it is to actually change the system to ward off disaster. Politicians who try and work for reform are confronted by mobilized public sector unions and other entrenched interests.

House Bill 4804 has been proposed in the Michigan legislature and would make it easier for citizens and local officials to reform their pension systems. According to MichiganVotes.org, the bill would "establish that counties and local governments may adopt an ordinance that prohibits granting employees a conventional 'defined benefit' pension (rather than a 401k), and if such an ordinance is adopted, prohibit government employee unions from making this issue a subject of collective bargaining."

Part 1 of an analysis of local municipal retiree systems in Michigan. Click here for Part 2 and here for Part 3.

~~~~~

See also:

Michigan Teacher Pension System Liabilities Rise Again

Michigan Taxpayers Paying More Money For Fewer State Workers

How Michigan Can Fix Its Pension Problems

Pension Costs Mean Tighter Budgets For Classrooms, Taxpayers

Commentary: Shifting School Employees To a 401(k) Is the Most Important Thing

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Property owners sue Dearborn over B&B ban

Property owners sue Dearborn over B&B ban

City officials split over whether East Lansing is in financial trouble

City officials split over whether East Lansing is in financial trouble

East Lansing climbs out of pension hole

East Lansing climbs out of pension hole