Detroit Homes With Willing Buyers Get More, But Overall Assessments Plummeted

Median sale price for a Detroit home up from $9,500 in 2010 to $26,000 in 2017

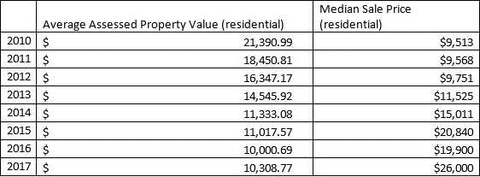

The median sale price of residential property in Detroit has almost tripled over the past eight years, while the tax assessed value of that median-priced property has decreased by more than half during that time.

In 2010, the median sale price of residential property in Detroit was $9,513, according to Realcomp, a real estate listing service. By 2017, the median price had increased to $26,000.

The median sale price increased every year out of the eight-year period except for one – 2016. The biggest increase took place between 2014 and 2015, when it increased from $15,011 to $20,840.

During that same period, the average assessed value of residential properties in Detroit decreased significantly. Property tax assessments exist for all properties, while far fewer properties are bought and sold in any year.

In 2010, the average assessed value of residential properties in Detroit was $21,391, according to calculations done by Michigan Capitol Confidential with data obtained from the city of Detroit through an open records request. In 2017, the average assessed value of residential properties was $10,309.

After decreasing every year between 2010 and 2016, the average assessed property value increased slightly between 2016 and 2017, going from $10,001 to $10,309.

The assessed value of a property is approximately half the estimated market value.

During 2011 to 2015, one out of every four properties was foreclosed on by Wayne County for unpaid property taxes. That means about 100,116 of the roughly 384,675 properties in Detroit were foreclosed by the county. That’s according to a paper written by Chicago-Kent College of Law professor Bernadette Atuahene and Oakland University economics professor Timothy Hodge.

According to Dorian Harvey, president of the Detroit Association of Realtors, the trends are connected to the Great Recession — which began affecting Detroit before it hit other communities — and declines in assessed values in Detroit.

“So what we were doing here is called ‘short sales’ and a lot of mortgages were foreclosed upon, and what happened because property values had dropped, a lot of folks were asking to be reassessed. So, at the reassessed valuations, everything got lowered,” Harvey said. “2010 is probably the middle of [Detroit’s] recession when the rest of the country was coming back.”

Harvey continued: “But we turn around in 2012, 2013. There’s a big demand, Detroit becomes ‘sexy’ and the whole world is buying real estate here, so our demand almost exceeds our inventory [of move-in ready housing] and valuations increased. Our prices began to appreciate. And that brings us to 2017. You’ll probably see tax assessed values begin to increase in the next five years as our [property] values have increased.”

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Michigan cities paid up to $63 million in police settlements from 2022 to 2025

Michigan cities paid up to $63 million in police settlements from 2022 to 2025

Detroit’s cider mill scores legal win, but the fight isn’t over yet

Detroit’s cider mill scores legal win, but the fight isn’t over yet

Even after bankruptcy, Detroit is in debt

Even after bankruptcy, Detroit is in debt