Foreclosing Over-Taxed Property Helped Wayne County Dodge State Receivership

Profits from auctioning tax-delinquent owners' homes shored up county budget in 2015-16

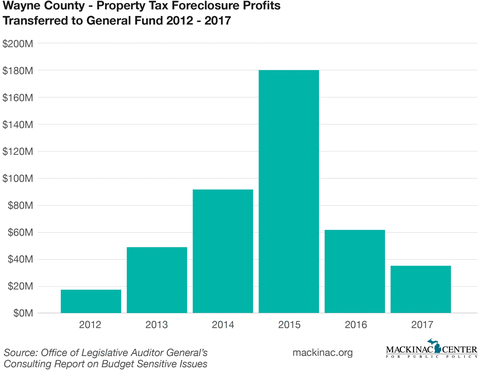

Wayne County used money gained from the sale of foreclosed properties to shore up its general fund, possibly helping it avoid a form of state receivership during what County Executive Warren Evans described as a financial emergency during 2015 and 2016.

In a March 2016 interview with Stephen Henderson on WDET’s Detroit Today, Wayne County Executive Warren Evans said, “The delinquent tax revolving fund from the interest and penalties on foreclosures is money that’s come to the county, and frankly did a lot of the lifting last year [2015] to get rid of a lot of the accumulated deficit.”

In 2015, Wayne County transferred $180.1 million in profits from property tax foreclosures to its general fund budget. The amount was sharply higher than the $91.6 million transferred the previous year, according to data in a state Auditor General report. In 2016, the county transferred $62 million.

Much of the profits from these property tax foreclosures came from the sale of tax-delinquent property in Detroit, where real estate values were hit hard during the Great Recession and the years following. Between 2007 and 2013, owners of at least 10,000 properties in the city were unable to pay property taxes on time for a given tax year, according to Loveland Technologies, a nationwide property data and mapping company.

Many of these owners were unable to repay the back taxes, and their property was sold at a county auction for tax-foreclosed properties.

Local governments routinely foreclose on and sell tax-delinquent properties. Some experts, including Chicago-Kent College of Law professor Bernadette Atuahene and University of Chicago professor Christopher Berry, argue that many of the foreclosures in Detroit were driven by the city’s inflated assessments of the properties’ value, which in turn meant inflated property tax levies and tax bills.

In February 2014 the State Tax Commission sent an order to the city of Detroit notifying officials of its concerns about property tax appraisals in the city. The following month, Detroit sent the commission its plans to conduct a citywide property tax reassessment.

Wayne County officials and Detroit Mayor Mike Duggan’s Office did not respond to emails requesting comment.

Jerry Paffendorf, CEO and co-founder of Loveland Technologies, believes that the large profits Wayne County experienced from tax foreclosures show it relies too much on foreclosures as a revenue source.

“At this point, it’s clear that Wayne County relies on the extra money it makes when people pay their property taxes late,” Paffendorf said. “Even with the reduction of foreclosures that are making it to auction over the last couple of years — which is still incredibly high — the number of people churning on payment plans, receiving foreclosure notices, and struggling to pay their late taxes remains almost as large as ever.”

According to data Loveland collected, the county has realized more than $300 million in profits from the foreclosure auctions from 2009 to 2016.

Michele Oberholtzer, director of the Tax Foreclosure Prevention Project at United Community Housing Coalition, a Detroit nonprofit, has similar concerns about the transfers.

“This is part of a very broken system that we have where we balance out budget by borrowing against the poorest residents and most of the consequences are delayed in terms of the costs, both financial and otherwise,” Oberholtzer said. “The number [of vacant and abandoned houses] is not really going down because we haven’t addressed the source, and we may have balanced our budget for those years, but we have fewer homeowners, fewer residents, fewer homes, as a result of the way we chose to structure our budget for the city and county budget.”

Oberholtzer is also a Democratic state representative candidate in the 4th District.

One out of every four Detroit properties entered the foreclosure process from 2011 to 2015 due to unpaid property taxes, according to a paper written by Atuahene and Oakland University economics professor Timothy Hodge.

Editor’s note: This article has been updated to properly reflect that from 2011 to 2015, one out of every four properties in Detroit entered the foreclosure process due to unpaid property taxes.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Michigan Supreme Court to hear retaliation case tied to Wayne County forfeiture program

Michigan Supreme Court to hear retaliation case tied to Wayne County forfeiture program

After decade-long saga, Wayne County to move to new jail

After decade-long saga, Wayne County to move to new jail

State health dept. classed Wayne, Oakland counties as ‘partially rural’ when seeking federal grant

State health dept. classed Wayne, Oakland counties as ‘partially rural’ when seeking federal grant