Mystery Project Almost Got $5.5 Million From Taxpayers

Funding for P20 project tied up with money losing real estate offering, corporate welfare

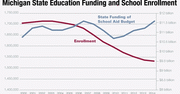

Superintendent Says District Worse Off Despite Getting More Overall State Money

Kalamazoo superintendent ignores tens of millions of dollars to make his case

Union Teacher Contract Has Illegal Racial Preferences Provision

Mt. Clemens superintendent says removing language would cost district in employee concessions

District Disputes MEA President's Claim About School Funding Cuts

Steve Cook said Wayne-Westland lost $40 million under Gov. Snyder; administration official says district received more revenue

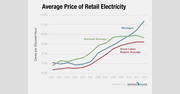

Electricity Competition In Texas, Illinois Brought Lower Prices Than Michigan

Cause of rolling blackouts remain in dispute

Michigan Paying $860 Million In Select Tax Incentives, Subsidies

Favored businesses get preferences

City Says Recording Device Ban Was Due To 'Miscommunication'

Grand Rapids says camera ban imposed at public hearing involving Acton Institute no longer in place

House Readies For Vote On FOIA Reforms

New bill would lower costs for citizens accessing public information from government

Electric Vehicle Battery Subsidy Failures Evident Early On

Former Gov. Granholm defends her policies in Detroit Free Press article

Non-Christians Given 'Special Consideration' In Union Teacher Contract

Ferndale Public Schools provision could violate state and federal laws

Asset Forfeiture Issue Arises With Clause in Human Trafficking Bills

Citizens could lose property under 'willful blindness' provision

More People On Food Stamps After Past Minimum Wage Increases

Nonetheless, Center for American Progress report contradicts recent trend

Union Intimidation List Back Up

Hurley Medical Center officials disavow responsibility for the list being reposted

Unions, Left-Leaning Groups Dominate List of Largest Political Donors

Twelve of the top 20 spenders are unions

SEIU Fined Almost $200,000 Over Actions Tied To 2012 Ballot Proposal Campaign

Union suffers another loss related to dues skim, which took more than $34 million from home-based caregivers

Tax Board Bans Recording Equipment In Hearing Involving Nonprofit

Grand Rapids debating whether Acton Institute is a charitable organization

Grand Rapids Says Nonprofit Acton Institute Not A Charitable Institution

City denied think tank's property tax exemption application; says Acton owes $91,000 in taxes