Officials Shortchange School Pension Fund 7th Year In Row

Author of pension study says management making up its own rules

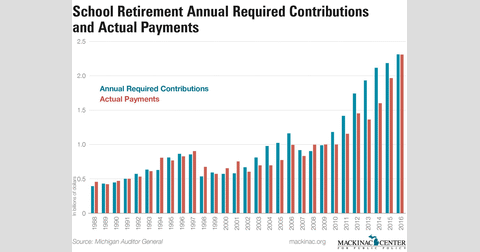

For the seventh year in a row, state officials did not make at least the minimum payment that the state’s own accountants say is needed to start filling a massive $26.7 billion hole in the school pension fund.

A just-released state financial report indicates that to catch up on the deficit in a reasonable number of years, officials were supposed to deposit an additional $2.31 billion into the pension fund for 2016. They did not. The actual shortfall was a relatively small $3.57 million, meaning officials put in over 99 percent of the recommended minimum. But due to the power of compounding, even small misses add to the burden.

Previous shortfalls have not been small. In 2013, decisions were made that meant shorting the actuarially required deposit by $567.76 million. In 2014, the miss was $516.72 million.

The Office of Retirement Services sets contribution figures after getting input from the administration and consulting the relevant laws.

The accountants say the amount the state needs to contribute this year if it wants to amortize the $26.7 billion pension fund shortfall in a reasonable number of years was $2.31 billion. That’s a record.

When the unfunded liability was much smaller in 1988, by comparison, just $396.2 million was needed that year. In inflation-adjusted terms, that was $803.8 million, slightly more than one-third the current actuarially required payment.

The skyrocketing payments are due to decisions made by state officials that have meant consistent underfunding of the school retirement system.

The state has not met the annual required catch-up cost contribution in 20 of the past 29 years. The shortfalls have compounded to generate the system’s current unfunded liability of $26.7 billion.

“Perceptions that Michigan has failed to fund the school employee retirement system simply are not accurate and represent a misunderstanding in how the funding of the required contribution works,” said Kurt Weiss, spokesman for the Office of Retirement Services, in an email. “Each year, the actuary determines the required contributions that our Office of Retirement Services (ORS) uses to set contribution rates that are designed to fully fund the retirement system over time. There is a time lag inherent between the required contributions being established and the dollars being collected due to budget timelines. ORS must submit the required contributions and estimated payroll figures two to three years in advance, leading people to misinterpret the data on funding levels.”

"If you want to include an example, when the 2017 contribution rates were established, the latest information available at the time was the ARC and estimated payroll based upon the 2014 actuarial valuation," Weiss said. "The contribution rates for 2017 are set based on the 2014 valuation. It’s important to understand that although there are some variations over time in what we set out to collect vs. what we actually collect, these variances (whether positive or negative) are smoothed over the subsequent five years and contributed to the system with interest."

James Hohman, assistant director of finance for the Mackinac Center for Public Policy, said the state sets its own rules for how to pay for the pension system and officials change them at their discretion.

"The rules they’ve chosen are part of the reason why the state has $26.7 billion in unfunded liabilities," he said in an email. Hohman has authored a paper on how to contain growing school pension fund liabilities.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.