Commentary

Property Tax Revenue On a Slow Rise

Value of property increased 12 percent over past four years

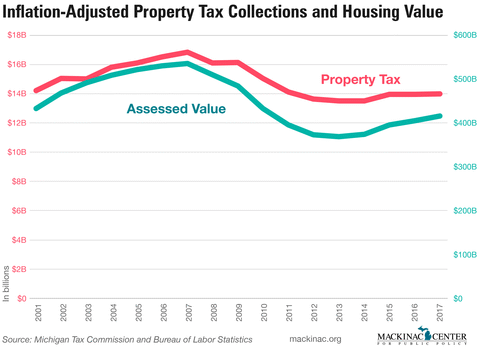

The largest source of revenue for local governments is property taxes. They raised $14.0 billion for the state, schools, community colleges and local governments in 2017, a 2.42 percent increase from the previous year. Property tax revenues are approaching their 2007 peak of $14.3 billion. But with inflation, they would still be 13 percent below these peak levels.

That’s not bad considering that the tax is based on the value of property in Michigan. Assessed values dropped 31 percent from 2007 to 2013 when adjusted for inflation. This is the value of all real estate, including industrial and commercial properties. Things may have been even worse for homes. According to the Michigan Association of Realtors, the average home sold for $192,000 in 2005, but this dropped to $114,000 in 2011. Nevertheless, assessed values are on the upswing since 2013.

A property’s taxable value cannot increase faster than inflation, a policy in the state constitution. But values are reset when a home is sold. This may explain why property tax revenue has lagged the increase in property values. But according to the Michigan Association of realtors, the number of home sales has been on the rise and is within 3 percent of 2005 peaks.

|

Property Tax Revenue On a Slow Rise

Value of property increased 12 percent over past four years

The largest source of revenue for local governments is property taxes. They raised $14.0 billion for the state, schools, community colleges and local governments in 2017, a 2.42 percent increase from the previous year. Property tax revenues are approaching their 2007 peak of $14.3 billion. But with inflation, they would still be 13 percent below these peak levels.

That’s not bad considering that the tax is based on the value of property in Michigan. Assessed values dropped 31 percent from 2007 to 2013 when adjusted for inflation. This is the value of all real estate, including industrial and commercial properties. Things may have been even worse for homes. According to the Michigan Association of Realtors, the average home sold for $192,000 in 2005, but this dropped to $114,000 in 2011. Nevertheless, assessed values are on the upswing since 2013.

A property’s taxable value cannot increase faster than inflation, a policy in the state constitution. But values are reset when a home is sold. This may explain why property tax revenue has lagged the increase in property values. But according to the Michigan Association of realtors, the number of home sales has been on the rise and is within 3 percent of 2005 peaks.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

More From CapCon