Michigan drivers pay top gas taxes but still hit potholes

Only 67% of gas taxes fund Michigan road repairs

Michigan drivers face some of the highest gas taxes in the nation, yet the state continues to rank near the bottom for road quality and funding.

In the 2023-24 fiscal year, Michigan collected an estimated $1.5 billion in motor fuel tax revenue. But much of it never touches the roads.

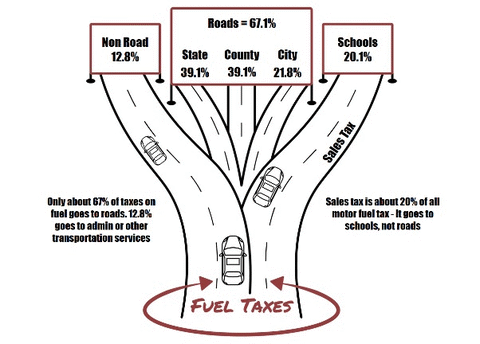

According to the Michigan Petroleum Association, only about 67% of fuel taxes fund road work, while 12.8% covers administration and transit services, and 20%—the sales tax share—goes to schools instead of roads.

Michigan Petroleum Association

Michigan Petroleum Association

Michigan drivers pay about $400 annually to fund road repairs through taxes and fees, according to the Michigan Department of Transportation. In addition, many residents continue to pay more than$750 a year for car repairs due to deteriorating road conditions, according to Gov. Gretchen Whitmer.

Michigan ranks among the top states for the highest gas taxes in the country, according to a study from the Tax Foundation.

The state currently imposes a motor fuel tax of 31 cents per gallon, ranking sixth nationwide. This is added to the 6% Michigan Sales Tax on gasoline purchases, totaling roughly 48 cents of tax per gallon.

In the last four years, the excise tax has risen from 26.3 cents per gallon to 31 cents per gallon.

House Bill 4571 raised the motor fuel tax by five cents per gallon, the first major increase since the new inflation-adjusted rate was created in 2015.

While Michigan is one of ten states to apply a general sales tax to gasoline, it is also among twenty-four states that use a variable-rate gas tax formula tied to inflation. The remaining twenty-six states rely on fixed per-gallon taxes that change only through legislative action.

According to the Citizens Research Council of Michigan, Michigan ranks 30th among all 50 states in road funding levels by an assessment of data from 2012 to 2021 and 40th in road system conditions using the latest available data.

A new proposal from House Speaker Matt Hall could shift how fuel tax revenue is collected and spent. The plan would raise $3.1 billion annually by reallocating $600 million from earmark spending, $1.1 billion through cuts to corporate welfare, $945 million from sales tax paid on fuel, and $500 million from projected revenue surplus.

“The plan removes the sales tax on gas and replaces it with a revenue-neutral motor fuel tax, which goes entirely to roads. Drivers will see no difference, but roads will receive more repair funds,” Hall’s press release stated.

The proposal focuses on funding local roads without creating new taxes or issuing bonds.

Whitmer has adopted provisions of Hall’s plan in her new MI Road Ahead Plan to direct all revenue from the 6% sales tax on fuel away from education and towards toward roads, bridges, and transit. This would generate $1.2 billion in infrastructure funding.

Facing a term limit, Whitmer proposed spending $7.8 million next year to study this road funding solution.

House Bill 4183 proposes to raise the tax on motor fuels from $0.31 to $0.51 per gallon, effective October 1, 2025. The bill has passed the house and is currently pending in the Senate Appropriations Committee.

Whitmer’s office did not respond to requests for comment.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Michigan offered $6B; company said ‘no’

Michigan offered $6B; company said ‘no’

Whitmer touts 38,000 jobs ‘announced’ but not created

Whitmer touts 38,000 jobs ‘announced’ but not created

Pothole fund pays 6% of submitted claims in 2024 and 2025

Pothole fund pays 6% of submitted claims in 2024 and 2025