Whitmer pitches $800M of new taxes in final budget plan

Smokers, gamblers, online advertisers among targets of five levies

Gov. Gretchen Whitmer recently pitched five tax hikes aimed at raising $800 million by taxing smokers and vapers, gamblers, and online advertisers in her 2027 budget proposal, her last as governor. Whitmer also wants to pull $400 million from the state’s rainy day fund to combat the state government’s higher Medicaid.

“Michigan is open for business and on the move, and this budget will deliver on the kitchen-table issues that make a real difference in people’s lives,” Whitmer said in a Feb. 11 press release. “My balanced budget proposal will build on our strong record of bipartisan success. It doubles down on shared, long-term priorities to create good-paying jobs, fix roads, save Michiganders money, and ensure every child can read, eat, and succeed.”

The governor said that her recommendation would provide targeted relief to seniors via an expanded tax credit. Families, she said, would benefit from a back-to-school sales tax holiday.

Whitmer’s budget director Jen Flood claimed that the budget proposal is responsible.

“As families across Michigan are tightening their belts, the state is too,” Flood said at the Capitol. “The budget recommendation we present today makes the most of every dollar we have. It does this through balance and discipline. We are proposing a responsible mix of new revenue, reductions in efficiencies and drawing from reserves to deliver a budget for the next fiscal year that benefits all Michiganders.”

House Speaker Matt Hall, R-Richland Township, rejected Whitmer’s tax hikes.

“We don't need tax hikes on working families or raiding the rainy day fund to make this budget balanced,” Hall said in a news conference Feb 11. “We just need to keep hammering away at the waste, fraud, and abuse the Lansing insiders love to protect.”

James Hohman, director of fiscal policy at the Mackinac Center for Public Policy, encouraged lawmakers to reject tax hikes.

“Lawmakers have had more money to work with in the state budget,” Hohman told Michigan Capitol Confidential in an email. “They ought to practice restraint and say no to the governor’s proposed tax hikes on smokers, vapers, gamblers, digital advertisers, and the people who throw things away.”

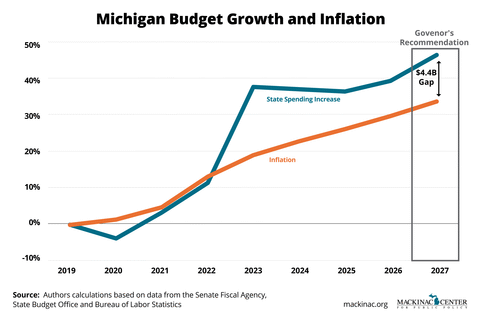

State spending has increased from $34.4 billion in fiscal year 2018-19 to the governor’s proposed $50.2 billion for fiscal year 2026-27.

Rep. Matt Maddock, R-Milford, said he preferred to cut waste before hiking taxes.

“The governor calls this the ‘Saving Michiganders Money Plan,’ yet she’s proposing multiple new tax hikes,” said Maddock in a Feb. 11 press release. “This is absurd. You don’t need to raise taxes on anybody when millions in wasteful and fraudulent spending are still sitting in the state budget waiting to be cut.”

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Whitmer budget peddles old programs as new

Whitmer budget peddles old programs as new

Whitmer spent $61k on Switzerland trip

Whitmer spent $61k on Switzerland trip

House approves deer baiting measure

House approves deer baiting measure